A new index that will serve as a yardstick for the growth and development of small and medium enterprises in South Africa has been initiated by Absa Bank’s SME Business Unit, the South African Chamber of Commerce and Industry (SACCI) and the Bureau of Market Research (BMR) as the research partner.

BMR outlines here how the index will be based on regular surveys and gives a detailed assessment of what the SBGI hopes to achieve in the context of the South African SME landscape.

South Africa’s small, medium and micro-enterprise (SMME) sector is a key driver of economic activity, employment and innovation. Of the estimated 2.67-million SMMEs in South Africa, approximately one-third operate formally, while two-thirds are informal. Collectively, the sector provides an estimated 11.4-million jobs, with small and medium enterprises (SMEs) comprising 91% of formal businesses, contributing around 60% of employment and approximately 34% of the national GDP.

Despite their critical role in the economy, SMMEs face persistent challenges that inhibit growth and sustainability. The Small Business Growth Index (SBGI) was designed to provide a comprehensive understanding of the SME landscape (50 or fewer employees), offering data-driven insights to inform policy interventions, improve business strategies and enhance SME resilience.

The lead parties involved in the SBGI initiative include Absa Bank’s SME Business Unit, the South African Chamber of Commerce and Industry (SACCI) and the Bureau of Market Research as the research partner.

Key trends in the SME sector

- The number of small businesses, employment rates and financial performance within the SME sector continue to decline.

- New SME entrant numbers remain low, with nearly a quarter of SMEs having operated for three years or less.

- SME profitability has declined dramatically, indicating systemic challenges affecting SME business sustainability.

- Higher failure rate of SMEs than elsewhere in the world with 70% to 80% of South African SMEs failing within the first five years.

These concerning trends highlight the need for a structured approach to support SMEs in overcoming both external challenges (exogenous factors) and internal weaknesses (endogenous factors).

External challenges (exogenous factors) affecting SMEs

Exogenous factors refer to external conditions that impact SME growth, including economic, regulatory and infrastructural constraints. Addressing these challenges requires coordinated efforts from government institutions, financial bodies and industry stakeholders.

How the SBGI addresses exogenous challenges

The SBGI will provide critical insights to policymakers, financial institutions and industry stakeholders to develop targeted solutions to address external challenges. By leveraging data from SME performance indicators, the SBGI will:

- Inform economic policies that support SME-friendly fiscal measures.

- Identify gaps in financial accessibility, ensuring that funding initiatives are directed effectively.

- Highlight regulatory constraints, enabling streamlined business registration and compliance.

- Offer sector-specific insights on infrastructure needs and advocating for better resource allocation.

- Monitor SME participation in domestic and export markets to promote a level playing field.

- Provide real-time data to measure the impact of anti-corruption and security initiatives on business operations.

Internal weaknesses (endogenous factors) affecting SMEs

Endogenous factors relate to internal institutional inefficiencies within SMEs, such as inadequate skills, poor financial management and limited strategic direction. Addressing these gaps requires business development programmes, mentorship and capacity-building initiatives.

How the SBGI addresses endogenous challenges

The SBGI will serve as a valuable benchmarking tool for SMEs, helping them identify areas of weakness and guiding targeted interventions. By analysing SME performance data, the SBGI will:

- Identify training and skills development needs of entrepreneurs.

- Identify cash-flow-management issues, leading to better financial literacy programmes.

- Guide SMEs in refining business strategies to align with industry trends.

- Support technology adoption by measuring progress in digital transformation.

- Provide comparative insights, helping SMEs improve customer-retention strategies.

- Explore and benchmark opportunities to increase access to markets.

The strategic role of the SBGI in SME development

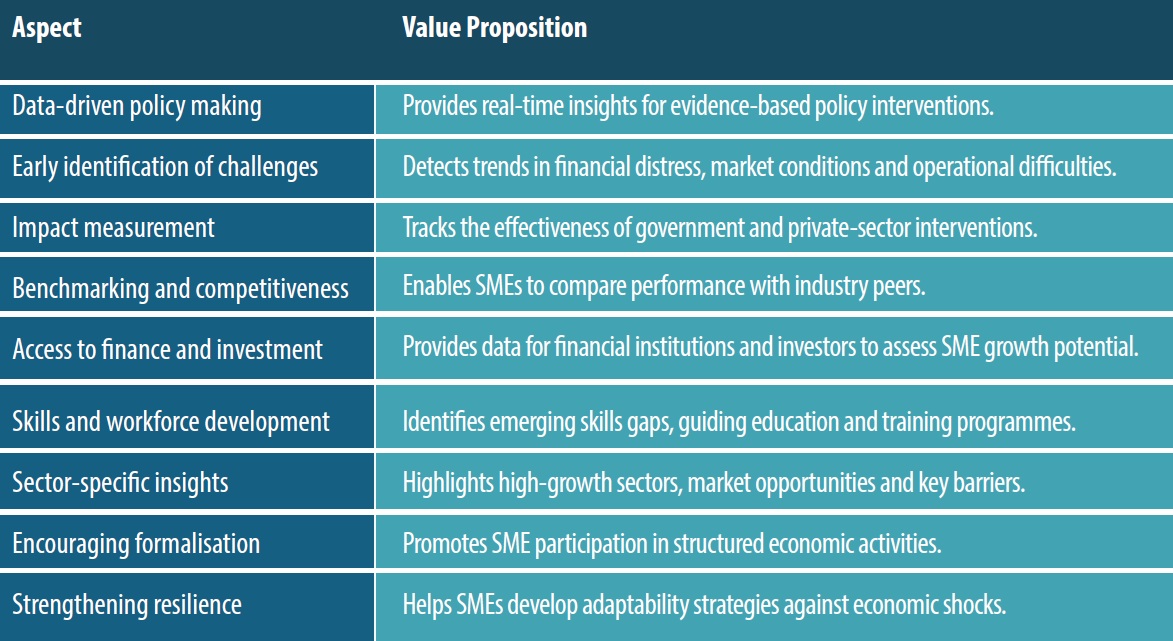

Beyond addressing specific challenges, the SBGI will play a pivotal role in shaping an enabling environment for SME growth. The value propositions of the SBGI are contained in this table:

Conclusion

The SME sector remains a cornerstone of South Africa’s economy, yet it faces mounting challenges that threaten its growth and sustainability. The Small Business Growth Index (SBGI) is a critical business-intelligence tool that ensures targeted interventions, enhanced policy formulation and improved SME resilience. By leveraging periodic self-administered surveys, the index fosters collaboration between SMEs, policymakers, financial institutions and industry leaders – paving the way for sustainable small business growth and economic development in South Africa.

The Small Business Growth Index (SBGI) is a critical business-intelligence tool that ensures targeted interventions, enhanced policy formulation and improved SME resilience.

The first SBGI survey will be distributed to SMEs for completion during April 2025 in all nine provinces of South Africa. This will provide SMEs with an opportunity to share insights regarding the growth and development challenges they are facing across regions, sizes and sectors. The SBGI initiative will also offer small businesses an opportunity to register as small business ambassadors who will also be granted an opportunity to participate in planned future government lobbying events.

The SBGI will be repeated in September 2025 to track changes in the dynamic small-business ecosystem of South Africa. In an aftermath of the two SBGI surveys in 2025, a Small Business Ambassador of the Year will be named. The overall intention of the SBGI innovation is to use the small-business intelligence resulting from the SBGI surveys to influence small-business growth and development policies and to realise the full potential of this crucial sector of the South African economy.

Contact details: Bureau of Market Research

- Key SBGI personnel: Prof DH Tustin, Prof CJ van Aard and Prof PK Kibuuka

- Email: deon.tustin@bmr.co.za

- Website: https://bmr.co.za/