Cape Town Mayor Geordin Hill-Lewis, accompanied by Alderman James Vos and ward councillor Mercia Kleinsmith, recently visited Bellville on Thursday, 8 June 2023 to witness the positive progress of the better. bellville. together. city funded placemaking initiative.

Under the administration of the Greater Tygerberg Partnership (GTP), this initiative aims to harness the potential of community assets, infrastructure, and services to create safer and cleaner public spaces in and around Bellville, promoting well-being and investment opportunities for economic growth.

During the visit, Mayor Hill-Lewis expressed his delight at the significant advancements observed in Bellville. “I am pleased to see that the central business district and station area have undergone impressive improvements, including the installation of entrancing public art, numerous new waste bins, vibrant plants, and extensive infrastructure repairs, including lighting. The continued progress of this economic development initiative in Bellville serves as an inspiration for other communities, showcasing the power of collaborative efforts in transforming urban spaces into thriving, vibrant hubs,” he said.

Alderman Vos, acknowledging the success of the initiative, emphasises the value of the City’s partnership with the GTP. “The GTP’s region-based focus and programmes not only stimulate investment appeal but also manage the aspirations of local businesses. The better. bellville. together. initiative stands as a shining example of placemaking initiatives that have the potential to create lasting positive change. This collaboration has led to the creation of much-needed jobs for the community and a reduction in reusable waste ending up in landfills,” Vos added.

The purpose of the better. bellville. together. campaign is to improve and sustain the area’s beautification, cleaner production, eradicate illegal dumping and littering, signage, promoting recycling and educating the public on the best waste management practices.

Local businesses in Bellville have rallied behind the project, which began in February 2023, and are actively participating in various recycling initiatives to maintain a cleaner, more sustainable public area that preserves the natural environment. So far, the better. bellville. together. has seen the clean-up of more than 160kg of recyclable waste such as cardboard, paper and plastic. In addition, more than 330kg of compostable waste, such as food scraps, have been collected and 595 illegal stickers and graffiti have been removed and almost 45 public benches have been repaired and painted.

Warren Hewitt, CEO of the GTP said that under the City’s cooperation with the organisation, several project teams have been hard at work on the clean-up Bellville project.

“The purpose of the better. bellville. together. campaign is to improve and sustain the area’s beautification, cleaner production, eradicate illegal dumping and littering, signage, promoting recycling and educating the public on the best waste management practices,” Hewitt said.

The mayor and accompanying officials also visited the Bellville Public Transport Interchange (PTI) and the newly established gardens, which further enhanced the overall experience and aesthetics of the area.

“The various new gardens planted in Bellville protects growth and the recycling initiatives help maintain a cleaner Bellville centre while diverting waste from landfills and providing a source of income for destitute people that could, over time, break the cycle of poverty. We challenge all businesses and the community of Bellville to get involved,” he concludes.

Easy ways for businesses to get involved:

We are looking for partners to join this campaign to make Bellville a better place to live and work.

If you or your organisations would like to support this initiative to clean-up Bellville – through extending donations or temporary use of equipment and resources – please contact ceo@gtp.org.za or call the GTP on +27 (0) 21 823 6713:

- Allow some time for your employees to arrange a clean-up, or sponsor a community clean-up to show your business cares. Be sure to share your efforts on social media with the hashtag #betterbellvilletogether.

- Show your support by cleaning your business visage, shop front and by keeping your entrance clean.

- Connect with the better.bellville.together. team at GTP – to learn more about how you can become a partner and how to support the clean-up Bellville project.

- Join the better. bellville. together. business organics waste collection service.

- Report illegal dumping tip-offs to our 24-hour toll-free number on 0800 110077.

More information is being shared amongst the Bellville residents and businesses, by means of local media. Regular updates are posted on social media platforms of CoCT and the GTP with updates to include livestreams of cleaning-up Bellville and visuals on the progress of the better. bellville. together. initiative.

A cleaner Bellville benefits all that work, live and play in Bellville – #betterbellvilletogether.

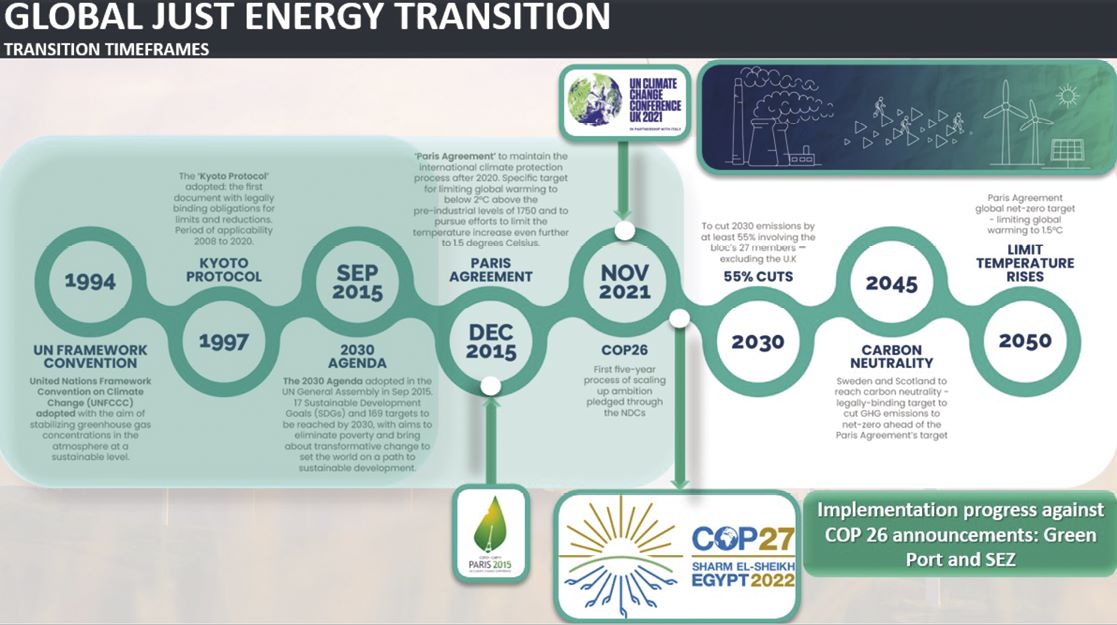

These are exciting times for exploration in South Africa. Both of these projects came about through the licensing authority of Petroleum Agency South Africa (PASA), the agency of national government which reports to the Minister of Mineral Resources and Energy (DMRE). PASA regulates and monitors exploration and production activities and is the custodian of the national exploration and production database for petroleum. Its role was statutorily endorsed in June 2004 in terms of the Mineral and Petroleum Resources Development Act of 2002.

These are exciting times for exploration in South Africa. Both of these projects came about through the licensing authority of Petroleum Agency South Africa (PASA), the agency of national government which reports to the Minister of Mineral Resources and Energy (DMRE). PASA regulates and monitors exploration and production activities and is the custodian of the national exploration and production database for petroleum. Its role was statutorily endorsed in June 2004 in terms of the Mineral and Petroleum Resources Development Act of 2002.

Mulilo CEO, John Cullum

Mulilo CEO, John Cullum