Something that we all have to do is make decisions and solve problems. Every day, we have a multitude of decisions to make. Some big, like buying a house or changing jobs, and others more mundane like what to make for dinner or what movie to watch. All of these decisions involve taking into account and managing variables.

Human beings are pretty good at solving problems and making decisions when dealing with a finite number of variables that are connected in predictable and familiar ways. For example, most of us know how to improvise with the ingredients available in our fridge or problem-solve when our computer doesn’t switch on.

Life gets a bit more complicated when we have to make decisions that involve dynamic and interconnected variables. For example, when we need to decide to change jobs, we need to consider finances, location and commute time, career growth opportunities, fitting into a new culture. Up to now, we were mainly able to make these decisions, even if we found them stressful.

In recent times, however, this has changed. Now we often find ourselves paralysed when needing to make decisions that seemed straightforward in the past. The world has become increasingly interconnected, and this has brought increased complexity and unpredictability. In today’s world, variables are dynamic and entangled in unexpected and unknowable ways. There are too many variables to keep track of or plan for, and there are many unknown or even unknowable unknowns.

Two years ago, no one knew that a then-unknown variable called Covid-19 would disrupt the entire world and fundamentally change our lives. Centuries ago, such a virus’s impact would have been more localised, and propagation would be slower. It took less than six months for the entire world to be impacted in today’s globally interconnected world. Now we collectively face a highly dynamic variable, a virus that keeps mutating (as viruses do). Not only have we become more aware that there are critical variables that we are unaware of in our web of interconnections, but also that our contexts are inherently volatile and uncertain and therefore unpredictable.

We are not used to being in such complexity and perpetual uncertainty.

For many, having to make decisions in this context is creating much anxiety. Especially in business contexts, decision-makers face dwindling revenues, anxious employees needing to cope with remote working and job insecurity, evolving business models, volatile markets, and increasing socio-political instability.

More than ever, it has become critical to develop a new kind of fitness to retain our ability to think clearly and respond appropriately while feeling fear and anxiety.

“Therefore, my sense is that those things which shift our nervous system from the sympathetic (fight or flight cortisol system) into the parasympathetic (connection, creativity, and play dopamine-led system) are those that help us thrive in Complexity. This would make nervous-system management a central complexity leadership skill. We need to first learn how to recognize when we are operating from our sympathetic nervous system and then learn to shift out of it.” – Jennifer Garvey-Berger

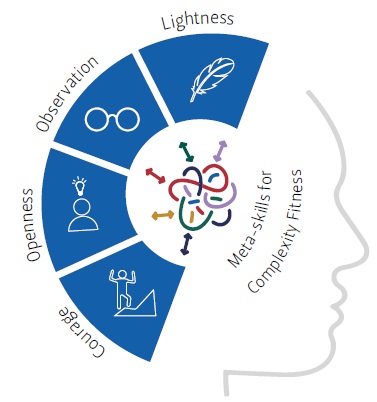

Meta-skills for complexity fitness

Complex adaptive systems are inherently uncertain, and while it may seem overwhelming at times, we do intuitively know how to navigate this Complexity. Families, cities, traffic – these are all complex systems. The problem is we tend to forget those skills in the workplace. Our decisions have much higher stakes in a world facing a pandemic, social unrest, and potentially existential threats like climate change.

In such a high-stakes, volatile context, we need a strong inner core, just like a surfer needs strong core muscles to be able to ride big waves. Over the years in our work with clients, we have found four meta-skills that help build this strong core for complexity fitness.

Courage – to face the unknown requires courage. We need to feel the anxiety and move towards the unknown despite it.

Courage – to face the unknown requires courage. We need to feel the anxiety and move towards the unknown despite it.- Openness – Complexity requires continuous learning and adaptation. We need to be open to unlearning and learning; we need to engage with curiosity, not rigidity, to diverse perspectives and difference.

- Observation – Complexity requires situational, self, and other awareness. It requires us to observe patterns in our context from multiple perspectives, to zoom into the micro and out to the macro. It also requires observing and noticing our own internal responses to this context, again with curiosity, not judgment.

- Lightness – Complexity, and emergence imply perpetual novelty. We can see this as an adventure and continuous discovery or as something that provokes anxiety. Being on the edge of not knowing means we will fail; it also means we need to reconnect to our childhood skills of imagination and playfulness. We need to hold our plans, our views, and our egos lightly.

“When the playful me shows up, I am ready to be a serious learner … a culture of playfulness I closely related to the capacity to learn.” – Rosemary Sutcliff

For more information, please contact Ansie Barnard: barnardam@ufs.ac.za